Make changes before April 2023 to optimise your dividend tax planning before the implementation of the UKs new Social Care Levy

Last year the Government announced that they were planning to introduce a new “Social Care Levy” from 6 April 2022. This is part of package of measures to fund the costs of social care and the NHS.

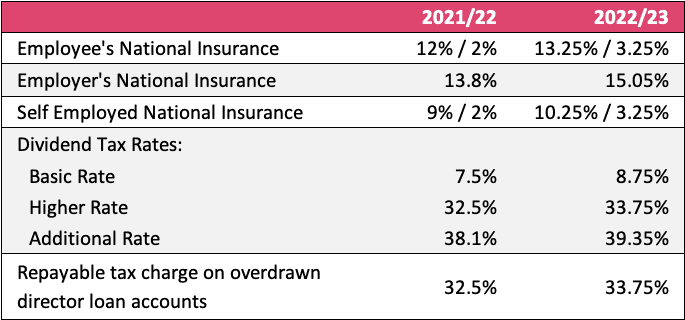

The following changes will be made:

From April 2023, once HM Revenue & Custom’s systems are updated, the Levy will be formally separated out and will be applied to individuals working above State Pension age and the National Insurance rates will return to their 2021/22 levels.

The hardest hit by the changes will be owner-managers of limited companies who pay themselves via salary rather than dividend as they will be suffer an overall increase of 2.5%. Such individuals may decide that it would be better to pay themselves by dividends for one year – if this is possible.

What could dividend tax planning save me?

The overall increase is not significant – for every £10,000 of dividend paid, the additional tax will only be £125 but anyone who is likely to pay significant dividends may want to bring this forward and make the payment before 6 April 2022.

There are some points to bear in mind when accelerating the payment of dividends:-

- The tax will become due 12 months earlier i.e. this will be due to be paid by 31 January 2023 rather than 31 January 2024 – the cashflow loss could easily wipe out the saving so this should be carefully considered;

- Payments on account for 2022/23 tax year – due 31 January and 31 July 2023 respectively – should be reduced due to the acceleration of the income, however, if the payments are reduced by too much then late payment interest could be payable, which would reduce the saving arising from accelerating the income;

- Care should be taken when paying interim dividends as HMRC generally only considered these to be “paid” when the money is either physically paid out to the shareholder’s bank account or it is “placed unreservedly at the disposal of the shareholders as part of their current accounts” – they normally take this as when the entry is actually made in the books and records of the company so if you pay dividend before 6 April 2022 but you don’t write up your books until after 6 April 2022 then you may accidentally push the dividend into the later year; and

- Prepare contemporaneously management accounts to demonstrate that the Company has sufficient profits to make the dividend payment otherwise HMRC will treat the payment as a loan.

It is fairly typical for HMRC to investigation large dividend payments made just before a change to the tax rates so it is important to get this right otherwise you may not get the benefit you were expecting.

If you have any questions or would like some assistance in working out how much to pay then please do not hesitate to contact us.